Do you know where to find your future financial customers?

We do.

YOUR NEXT GENERATION OF CUSTOMERS

GEN Z

Born 1995-2009

Represents 30% of the world’s population

Will count for 1/3 of global consumers by the end of the next decade

GEN ALPHA

Born 2010-2024

More than 2 billion strong

Makes up the largest generation in history

Estimated to wield $5.46 trillion in spending power by 2029

These are not small numbers. The next two generations, the one currently coming of age and the one directly behind it, hold immense purchasing power. Right now, they are in school and by sponsoring a financial literacy education program in your community’s school, you can:

Increase customer engagement

Build brand loyalty

Break the cycle of financial illiteracy in families

For banks, young people in Gen Z and Gen Alpha are your growing number of customers now and into the near future. Their influence is already felt.

For example, Gen Z’s spending power is currently high both directly and how they influence spending by their parents. It is estimated that the total spending power of Gen Z today is $3.4 trillion. In the US it is thought that their direct spending power could be as high as $143 billion.

This influence and impact are not going to diminish as Gen Z grows into their full potential and Gen Alpha makes their entrance. It is only set to get stronger.

The question is: How can you harness it?

By providing today’s young people with the foundational financial literacy education they need, you will forge a connection with your future customers. A connection you can build upon and grow as they grow.

For Gen Z and Gen Alpha too, NTC has a set of recommendations that show you how this growth can happen organically and with far-reaching impact.

KEY TAKEAWAYS

In our rapidly evolving world, financial literacy for Gen Z, and Gen Alpha, will be more important than ever.

Put simply: When young people lack the financial knowledge they need to make informed decisions, they are more likely to become trapped in cycles of poverty and debt. For example, poor spending and borrowing habits often result in low credit scores, contributing to higher financial insecurity.

Yet, simply put again: Financially literate people are generally less vulnerable to financial fraud. A strong foundation of financial literacy can help support various life goals, such as saving for education or retirement, using debt responsibly, and running a business.

Nearly all research papers produced by academia, and government agencies are in consensus that intelligently crafted financial literacy programs can mold the behaviors of individuals to align them with long term financial objectives.

By teaching young people these skills now, you harness their potential and engage your future customer base with authentic brand loyalty.

What does NTC’s financial literacy programming look like?

That’s the thing. NTC’s programming is customized for our clients . Our tailored creative engagement strategies and targeted outreach methods help you reach the community you want to reach with the message you want to send.

Financial Illiteracy in Youth Leads to Ill-Equipped Adults

By providing engaging financial literacy programs for the youth in your community, you can make an impact that will be felt for a lifetime.

Ready to implement a high-impact, turnkey solution for financial literacy through education and outreach?

Let’s start the conversation.

CONTACT ME

Nikki Swoboda

nswoboda@ntccorporate.com

763.452.1167

A Winning Formula for Financial Literacy Education

Top 10 recommendations for reaching out to your next generation of customers

The latest on NTC financial literacy programming

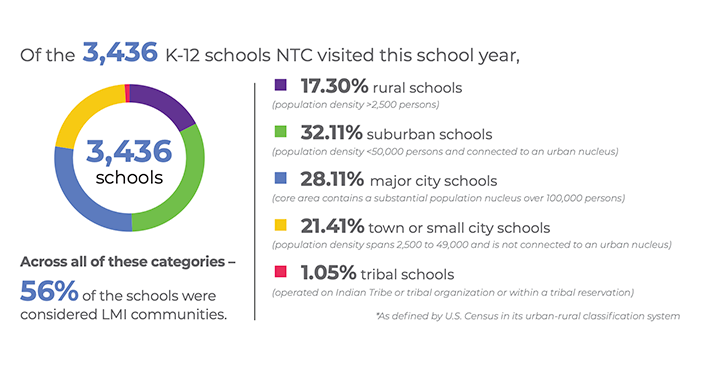

NTC's expertise in targeted outreach and open access reaches LMI communities

NTC programming is better than a lecture